Effective Date: March 26, 2020

Please note: This FAQ document replaces any and all previous versions.

Currently Available in English Only.

Can I receive COVID-19 testing even if I have no symptoms?

Since medical benefits are largely limited to expenses related to unforeseen emergencies requiring immediate attention, elective testing for COVID-19 is unfortunately not covered. If you are in Canada, please check with your province’s Ministry of Health for COVID-19 testing details. For example, in Ontario, COVID-19 testing is covered at no charge, regardless of your eligibility under the Ontario Health Insurance Plan.

Where do I go for COVID-19 testing?

If you are in Canada, please visit the website for your province’s Ministry of Health to view a list of assessment centres in your area.

Are over-the-counter COVID-19 screening kits (such as those available in pharmacies) covered?

Unfortunately, over-the-counter medications, including screening kits, are not covered.

Does my policy cover medical expenses related to COVID-19?

All policies with effective dates before the Government of Canada’s global travel advisory issued on March 13, 2020 will cover emergency COVID-19 treatment not covered by government insurance, provided the trip destination was not under a travel advisory at the time of departure. It must be noted, however, that governments normally cover pandemic-related treatment costs.

Will my policy provide repatriation coverage if I get COVID-19 and need to be returned to my home country?

Unfortunately, our Assistance service excludes coverage for repatriation that requires transportation in a biohazard isolation unit.

Am I covered by trip cancellation or trip interruption insurance?

Canadian travel insurers determine this on an individual policy basis. Policies purchased after the Government of Canada’s global advisory against non-essential travel issued on March 13, 2020 may not provide coverage for trip cancellations related to COVID-19.

What do I do if I get sick while I am travelling?

If you begin to feel symptoms related to COVID-19, contact Assistance at 1-866-883-9787, toll-free from Canada or the United States, or at 1-416-640-7865 from anywhere in the world.

Assistance will help to assess your symptoms and direct you, as needed, to a hospital or clinic for the appropriate care. Depending on your specific situation, Assistance is also available to:

- Provide interpretation services to help you better communicate with health care personnel

- Advance funds to a service provider if you’re required to pay up-front for medical care

- Monitor your case through to recovery

When consulting with a doctor, be sure to disclose if you visited any high-risk areas or have been in contact with anyone who has shown COVID-19 symptoms.

Will I be covered for self-isolation or quarantine—for example, if I need a hotel room?

Precautionary quarantines imposed on travellers due to government restrictions, including upon arrival at a destination or upon return to their home country, are not covered under our Discover Canada policy. However, if your return to your home country is delayed due to a precautionary quarantine, your coverage can be extended provided you remain eligible. Coverage is automatically extended for up to five days under certain circumstances (ex: delayed return due to flight disruption or hospitalization).

Provided their policy took effect before March 13, 2020, insured individuals hospitalized due to COVID-19 infections will be covered the same as with any illness. However, this does not include self-isolation outside of a hospital, as our policies do not cover additional living expenses.

Will my policy limit or end coverage if an official advisory is issued by the Government of Canada?

Most policies exclude expenses incurred in locations for which an advisory was issued before departure. As the Government of Canada advisory against all non-essential travel was issued on March 13, 2020, policies for trips taken after this date would not cover COVID-19 related expenses.

Policies with an effective date up to March 13, 2020 will continue to provide coverage for unforeseen emergency expenses related to COVID-19, as per policy terms. New Canadian government advisories will not affect COVID-19

coverage in these policies. However, expenses related to COVID-19 will not be covered for any travel to, from, or through a country for which the Government of Canada had issued a travel advisory prior to the effective policy date.

Can I still mail information, such as original documents regarding claims, to MSH International?

While our offices are still open and mail continues to be delivered, we kindly ask that claims and supporting information be submitted online or via email.

What if I get sick returning to Canada from abroad?

If you have travelled, or have been in contact with someone who has travelled:

- Stay home and avoid contact with others for 14 days

- Contact your local public health authority within 24 hours of your arrival in Canada

- Follow up with your health care professional

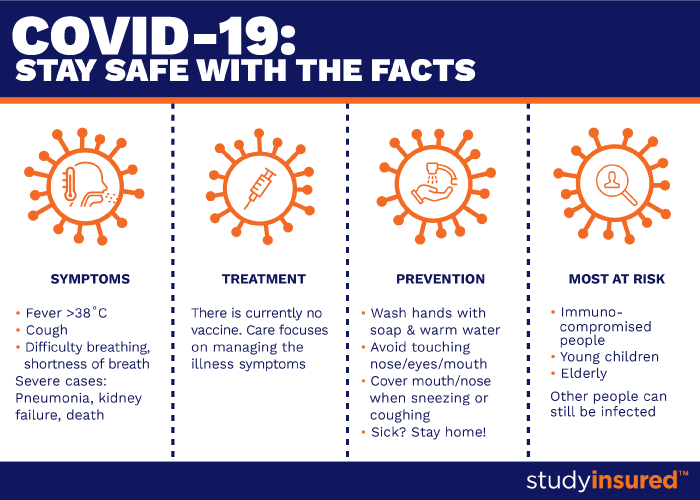

Closely monitor your health. If you develop fever, cough, or difficulty breathing over the 14 days after your return:

- Call your health care provider or your local public health authority

- Disclose your symptoms, travel to the outbreak area/area under travel advisory, and/or any contact with individuals with symptoms

If you are sick and need medical attention in Canada:

– Notify the medical clinic or hospital in advance. Disclose your symptoms and/or your travel abroad. DO NOT take public transit, an Uber, or a taxi!

– Wear a mask while waiting for or receiving treatment to prevent spreading the illness

If you feel sick before your departure for Canada:

– Do not use any form of public transportation

– Seek medical attention immediately

If you feel sick during travel to or upon your arrival in Canada:

– Inform the flight attendant, cruise staff, or a border services agent. They will decide whether medical assessment by a quarantine officer is needed

My expatriate plan covers 100% of my medical costs. Does this include care related to COVID-19? Are there reimbursement limits?

All existing MSH International expatriate policies will cover COVID-19 the same as any other illness, based on each policy’s terms and conditions. Any specific exclusions would be listed in the policy exclusions.

My doctor postponed my medical appointment because of COVID-19 and my insurance has since expired. As the postponement wasn’t my fault, will this appointment still be covered?

Unfortunately, since the policy has expired, the appointment will not be covered.

Are there specific hospitals where I can be treated for COVID-19?

Most hospitals are equipped to handle patients with COVID-19 illness. The MSH Provider Tool can provide you with more details on nearby hospitals in our network. If you are seeking COVID-19 treatment, it’s crucial that you call ahead and notify the hospital of your symptoms before visiting.

Who do I contact if I am showing COVID-19 symptoms?

Contact your primary care physician or your province/state’s local public health department for medical guidance and protocols. It’s important to maintain a distance of 2 metres (6 feet) from others at all times.

I’ve called the health department in my area but can’t reach anyone. What do I do?

If your COVID-19 symptoms are minor to moderate, isolate yourself at home. If you live with others, stay in a separate room, or keep a 2 metre (6 foot) distance away. Continue trying to reach your local health department or primary care physician. If your symptoms worsen (for example, difficulty breathing), call 911, the emergency room of your local hospital, or your urgent care centre. It is crucial to notify them of your condition before you arrive so that the medical team can take the proper precautions.

Contact your account manager if you have any questions about your coverage.