As the Canadian/US border shutdown moves towards autumn, snowbirds and short- term winter vacationers are being left with little time to plan their next moves or commit to travel plans that many have considered their God-given right during inconsiderate winter weather.

Though many Caribbean countries and Mexico have sent a hearty welcome to their northern neighbours, (see our previous article on this issue) there are some caveats that go with the invitation—masks, distancing, virus test verifications, stripped-down luxuries, even beach and surf patrols to ensure proper behaviour. Not great, but perhaps tolerable considering the alternative.

Florida at ground level.

Despite these offerings by other warm weather destinations, Florida remains Canada’s pre-eminent winter vacation destination, and given the recent reports of COVID surges throughout the state, many of them somewhat overblown, let’s take a ground level look everyday life in the Sunshine State today and what Canadians might expect to see and experience, should the border be freed of its current restraints.

Normalcy has not returned to Florida, but it has begun and is gaining momentum day by day.

Traffic is heavy and annoying. But that’s normal. Publix, Walmart and Costco are fully-stocked and doing big business—but masks and six-foot distancing are mandatory indoors. Most restaurants are open with spacing limitations. Open air venues are especially popular, and most are allowed to serve alcohol in its various formats. Malls are humming, and barbers, nail salons, gyms are for the most part open and operating quite well with mask and distancing requirements.

Hotels and resorts are open and doing a fair business from local travelers, with all of the health precautions in place—masks and distancing required until further notice. Generally, the rules are set locally, more stringent application in high density areas.

Most public beaches are being regulated and patrolled. The sand and sea is where it used to be, although the scenes of rowdy, alcohol-lubricated 20 and 30 year-old “students” and hangers-on cavorting mask-less throughout the July 4th weekend have precipitated tighter beach access—particularly in urban areas like Miami Beach.

As for the continuing presence of COVID, troublesome surges have generated unwelcome headlines for local businesses although Governor Ron DeSantis has vowed to keep the opening going and to have schools operational on schedule in mid-August.

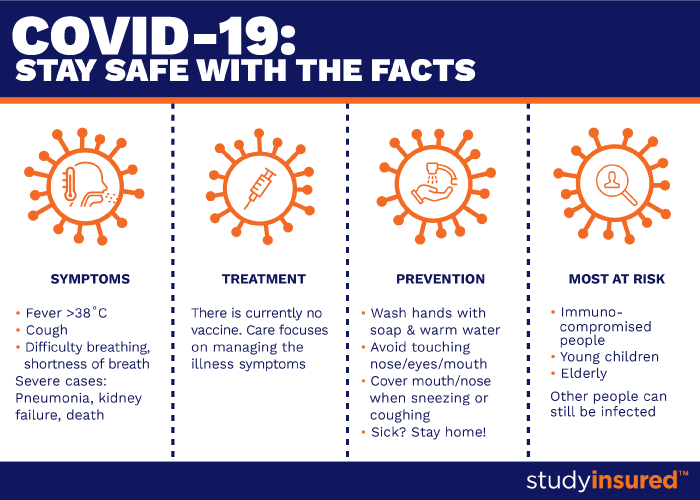

COVID data as of July 21, 2020.

Florida’s Department of Health, which issues detailed daily reports from all counties and all testing sites

throughout the state has confirmed spiking of COVID transmissions, primarily in metropolitan areas: Miami-Dade, Broward, and Palm Beach counties accounting for about 48 percent of Florida’s new cases—and Miami Dade for more than half of all cases in this three county area. These data refer to individuals newly testing “positive” with the COVID virus, as opposed to those testing “negative.”

Since last weekend ending July 19, when as many as 156 deaths were reported over the previous 24- hour period, the daily death count has dropped to 90. But I note that COVID daily death counts are not necessarily accurate indicators of the spread or severity of infections at any given time as deaths may occur long after the initial diagnosis or infection—weeks or even months.

With well over 100,000 tests being conducted per day throughout Florida it was expected the detection of positives would rise, and it was until July 19. Perhaps a moderation is now setting in.

Hospitalizations have consequently risen, particularly iin Miami Dade, but Florida health authorities claim that statewide, there is sufficient hospital capacity to deal with the current numbers of new cases.

How do these rates compare to Canada’s experience with COVID? According to the Johns Hopkins Coronavirus Resource Center, Florida’s COVID- related death rate is 23 per 100,000 population, which compares very nearly to Canada’s COVID mortality rate of 24 deaths per 100,000 population. And despite the high media profile, Florida’s Covid -related death rate is at the mid-point of all other states, 24th out of 50.

We can all hope that deeper into the fall and certainly into the winter season, these data will be less intimidating and more normal travel conditions (with many fewer imposed restrictions) will prevail.

Regardless, you’ll have to be especially diligent in choosing your health insurance—both for cancellation as well as for medical benefits. Forget about the way you have buying insurance in the past. Looking for “cheap” insurance or waiting until the day before departure to make this important purchase is not healthy. Ask questions, read your policy thoroughly, consult with your doctor if you have the slightest questions about your health status, and demand clear and straightforward answers from your broker or travel advisor. Know what you’re buying.

© Copyright 2020 Milan Korcok. All rights reserved.